Examples are essential groceries, health insurance premiums, and heating. Needs or Wants?Īn additional classification that you can use to take more control of your finances is the one between needs and wants.

The more you use your car or go out with friends, the higher your variable costs will be. These costs tend to vary as a result of lower or higher consumption. entertainment (cinema, concerts, events).Sometimes the change can be minor, while others it can be significant. In contrast, variable expenses are those costs that tend to change each month based on your consumption. Sometimes service providers will change their fees unilaterally and inform you in advance by email or letter. They are usually monthly bills and rarely change from month to month unless you negotiate new conditions on your loans, change utility providers, complete your studies, etc. phone, internet, and other utility bills.Fixed Expenses (AKA Regular Bills)įixed expenses are recurring costs that tend to be the same over time. Whether you are budgeting with biweekly pay or not, the first step consists of dividing your costs into fixed and variable expenses.

#Bi weekly budget calendar how to#

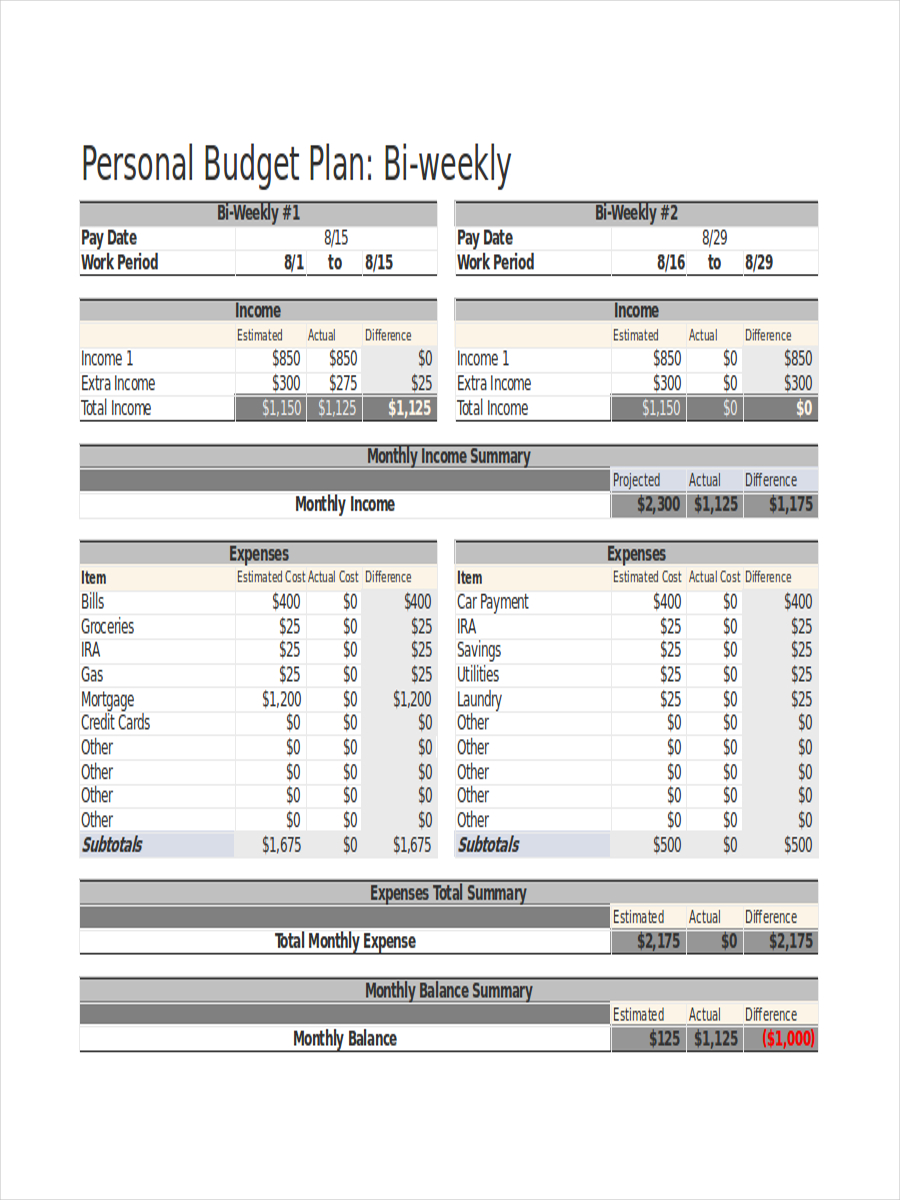

Then, it will show how to budget with biweekly checks easily and effectively.

This article will first give you an overview of general budgeting principles. Many ask themselves if budgeting with a biweekly frequency is different than doing it with a monthly one. Posted at 13:20h in Work, Budgeting by Level 0 CommentsĪccording to data provided by the US Bureau of Labour Statistics, biweekly checks are the most common payment frequency.

0 kommentar(er)

0 kommentar(er)